Investing in yourself shouldn’t mean compromising your future. Wesleyan’s tuition is among the Southeast’s most affordable - and we never charge extra for out-of-state students. Nearly every student receives aid, and our average package of scholarships, grants, and need-based assistance drives your net cost below many public institutions.

We know budgeting for college can be stressful. That’s why our personalized approach to financial aid begins before you ever step onto campus. Our dedicated team will guide you through every detail - whether it’s navigating forms, estimating your student bill, or identifying additional resources to help finance your education such as state grants, endowed awards, or campus jobs. We’ll walk you and your family through the entire financial aid process step by step, ensuring you fully understand and leverage all available aid opportunities.

At Wesleyan, affordability doesn’t mean sacrificing quality or community. It means providing you and your family personalized, compassionate support every step of the way. Connect with our counselors today and discover how we humanize and simplify the college application and funding experience. We care deeply, and we’re here to make your meaningful college journey both achievable and affordable.

When you apply to Wesleyan, you’re automatically considered for generous entrance scholarships ranging from $40,000 to $64,000 over four years, and you’ll receive your admission decision within days. For Premier Scholarships like the prestigious $80,000 CEO Women in Leadership Scholarship or our full-ride scholarship opportunities, submit a separate application by February 2, 2026. Submit your free application today to unlock all these opportunities.

Your Free Application for Federal Student Aid (FAFSA) must be submitted in order to be considered for state and federal financial aid. The earlier you apply, the earlier we can issue your financial aid package! Apply at studentaid.gov - Wesleyan’s FSA I.D. is 001600.

Entrance Scholarships

Worth $40,000 to $64,000 over four years ($10,000 to $16,000 per year), these are awarded automatically when you submit your application to Wesleyan based on your GPA. If you are admitted to Wesleyan, you’ll receive your scholarship amount on your Letter of Acceptance.

Creating Equal Opportunities (CEO) Women in Leadership Scholarship

Worth $80,000 over four years ($20,000 per year), this award is open to students with a minimum weighted cumulative GPA of 3.5. Ideal candidates show initiative, a drive for change, and understand why representation matters in every field. The CEO Scholarship supports students with a bold vision for advancing equal opportunities for women in leadership. Recipients also receive access to Wesleyan’s famous CEO Leadership Institute, a two-semester program in their first year, gaining mentorship, hands-on learning, and professional networking where you’ll build confidence, connections, and career skills. To submit your CEO Scholarship application, apply to Wesleyan, and then log in to your Wesleyan College Application Portal after admission to access the digital application forms for all scholarships available.

Premier Scholarships

These include full scholarships that can cover all your tuition costs! View our full list of Premier Scholarships to learn about the exciting opportunities available for you and eligibility criteria for each scholarship. To be submit your Premier Scholarship application, apply to Wesleyan, and then log in to your Wesleyan College Application Portal after admission to access the digital application forms for all scholarships available.

Athletic Scholarships

Athletic scholarships are available and awarded by our coaching staff to NAIA-eligible student-athletes. Awards may be combined with academic and need-based aid. Interested? Apply to Wesleyan and connect with your coach at Wesleyan Athletics to learn more.

HOPE Scholarship

Worth an estimated $5,970 per year. Eligible students must graduate with at least a 3.0 calculated HOPE GPA.

Zell Miller Scholarships

Worth an estimated $5,970 per year. Eligible students must graduate with at least a 3.7 calculated HOPE GPA in addition to qualifying scores on the ACT or SAT.

Georgia Tuition Equalization Grant (GTEG)

Worth an estimated $1,100 per year for attending private colleges in GA.

Federal Pell Grants

Worth varies, up to $7,395 per year. Eligible students must demonstrate financial need as determined by the FAFSA based on income and other factors.

Federal SEOG

Worth varies, up to $4,000 per year. Offered to low-income students who need additional financial support. The student must be Pell eligible as determined by the FAFSA.

Federal Student Loans

Worth varies, between $5,500 to $12,500 per year. Federal student loans are borrowed by the student and must be paid back with interest. Subsidized loans are financial need-based and do not accrue interest while enrolled in school. Unsubsidized loans are available to most students and do accrue interest while enrolled in school.

Parent PLUS Loan

Worth varies, up to Cost of Attendance. This federal loan is available to parents of

dependent undergraduate students who complete a credit check. If the parent is denied in the application process, the student gains access to additional

Unsubsidized federal loans.

If you are a veteran, a survivor, or a dependent of a veteran you may be eligible. Wesleyan College is proud to be a Yellow Ribbon School. Download our VA Benefits Flyer to learn more.

If we’re serious about accelerating equality for women, we have to make education accessible. That means being transparent about cost and committed to real support. At Wesleyan, financial aid isn’t just paperwork — it’s how we help every student take their next step with confidence. And because we believe opportunity shouldn’t depend on geography, our tuition is the same for both in-state and out-of-state students.

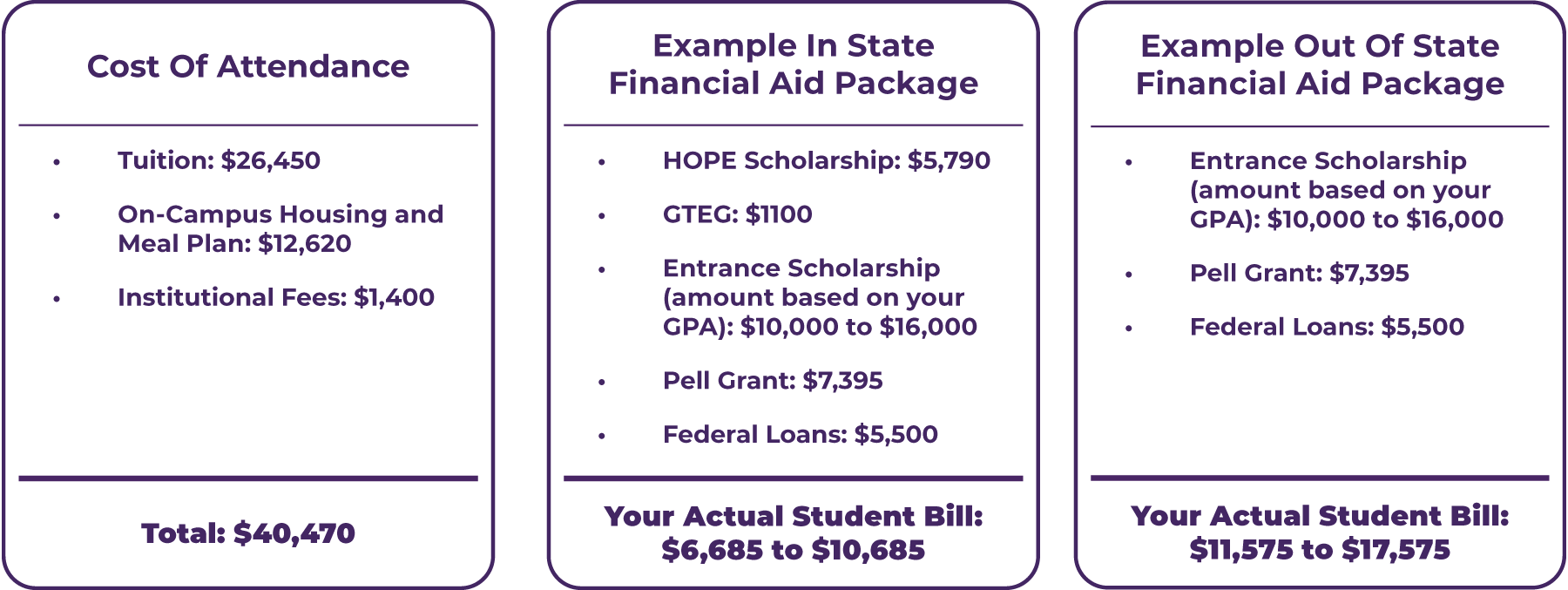

*These are sample student bills for illustrative purposes only, actual amounts may vary based on eligibility criteria. Apply early and submit your FAFSA to receive your official personalized financial aid package.*

We understand that the financial aid process and award packages can be daunting, and we're committed to making sure your experience is as smooth as possible. That's why we've created Wesleyan's Ultimate Guide to Financial Aid.

Applying for financial aid is easier than you might think, especially with our team supporting you. Follow these simple steps to maximize your aid opportunities. Remember: we’re with you at each step, so you’re never on your own in this process.

Your first step is to submit your application for admission (and get accepted). Once you’ve applied and been admitted to Wesleyan, you’re automatically evaluated for academic merit scholarships – no separate form needed. Initial entrance scholarships for first-year students range from $10k to $16k per year ($40,000 to $60,000 over four years) as noted above, and you’ll receive one with your acceptance if you qualify. These scholarships are guaranteed for 4 years as long as you remain a full-time student and meet minimum GPA requirements.

Tip: Apply early! Wesleyan has rolling admissions, but applying by our priority deadlines ensures you also meet priority financial aid deadlines. Early applicants get admissions decisions (and merit scholarship notifications) sooner, giving you more time to plan financially.

The FAFSA is the most important form for need-based financial aid – it’s how you access federal grants, loans, work-study, and even Georgia state aid like HOPE & Zell Miller Scholarships. We strongly encourage every family to file the FAFSA, regardless of income, because it’s the key to unlocking many sources of assistance. The FAFSA becomes available each year around October 1 for the next academic year. Try to submit it as early as possible – ideally by January or February of your senior year – to meet priority aid deadlines and maximize your aid eligibility.

Wesleyan’s FAFSA Code: When you fill out the FAFSA, list Wesleyan College (school code 001600) so that we receive your info.

Tip: Don’t wait! Even if you’re still applying for admission or haven’t decided on a college, go ahead and file the FAFSA early. You can list multiple schools. Meeting Wesleyan’s priority FAFSA deadline (usually around February 15) ensures you get full consideration for aid and scholarships. And remember – the FAFSA is free to submit (ignore any websites asking for payment). Need help with the FAFSA? We’re happy to assist (and we host FAFSA 101 workshops to walk you through it!)

Once you’ve been admitted to Wesleyan and submitted your FAFSA, our Financial Aid Office will put together a personalized aid offer for you. As soon as we have your FAFSA data (typically starting in late fall or early winter of senior year for early applicants), we’ll email you a financial aid award letter detailing all the aid you qualify for. This aid package will include:

What to do when you get your offer: Read it carefully with your family. We know all the numbers can be confusing, so we’re here to explain anything you don’t understand. Your award letter will include instructions for next steps. Generally, you’ll log in to our WesPortal system to accept or decline each part of your aid offer (for example, you’ll confirm which scholarships and grants you’re accepting – free money, yay! – and whether you plan to use the offered loans or not). We’ll also tell you if we need any additional documents at this stage.

Tip: Stay on top of your email. We send important notifications if we’re missing something (like verification documents – see FAQ below). The sooner you complete any outstanding requirements, the sooner we can finalize and credit your aid.

After reviewing your package, it’s time to accept your financial aid officially. You’ll do this through our online portal by accepting awards and signing any necessary documents. A few things to take care of in this step:

At this point, you’ll have officially accepted your aid for the year. Congrats! Remember that financial aid isn’t a one-time thing – you’ll repeat the FAFSA each year and we’ll renew your aid package, adjusting as needed for any changes in your family’s situation or educational costs. But we’ll remind you about that when the time comes.

Even after you’ve taken care of the paperwork, we know you and your family might have more questions. We encourage you to stay in touch with our Financial Aid Office to ensure you feel comfortable with your college financing plan. This could include:

Tip: Keep communicating. We genuinely mean it when we say we’re here to help make Wesleyan affordable for your family. If something is unclear or you’re worrying about any aspect of paying for college, contact us sooner rather than later. We can often find solutions together. As one of our core promises: “Wesleyan’s financial aid office can walk you through the process and get you where you need to be” – from start to finish, we’ve got your back!

Below are the frequently asked questions about FAFSA and Financial Aid. If you have any additional questions, please don’t hesitate to reach out!

A: The FAFSA stands for Free Application for Federal Student Aid. It’s a single online application (at Studentaid.gov) that the government and colleges use to determine your eligibility for financial aid – including federal grants, loans, and work-study, as well as many state aid programs. Every student who wants financial aid should complete the FAFSA. It’s free to file, and it’s not as daunting as it sounds. The form asks for financial information about your family (like income and taxes) to calculate how much aid you qualify for. Bottom line: Submit the FAFSA so you can access available funds to help pay for college. Even if you think your family income is too high for need-based aid, filing the FAFSA ensures you’re considered for all options – and it’s required for federal student loans and some merit scholarships too. Don’t worry, we’ll help you if you need it!

A: For most students, the FAFSA is the only application needed for financial aid at Wesleyan. We do not require the CSS Profile or any additional institutional financial aid form. If you’re a Georgia resident, as mentioned above, the FAFSA also covers your application for HOPE, Zell Miller, and GTEG state aid. (Alternatively, Georgia offers the GSFAPP on the GAfutures website for state aid only, but if you do the FAFSA, you don’t need to do GSFAPP.) The only other “forms” you might encounter would be verification documents (which we’ll request only if you’re selected for FAFSA verification) or perhaps separate scholarship applications for a few of our special programs. For instance, Wesleyan’s premier scholarships (like specific talent or interest-based awards) may require an interview, audition, or portfolio, but we will notify you if you’re eligible to apply for any of those. In short: focus on your admission application and FAFSA – those unlock the majority of aid available.

A: Yes! Wesleyan College students who are Georgia residents can absolutely benefit from the HOPE Scholarship or Zell Miller Scholarship, just as they would at a public university. If you graduate high school with HOPE or Zell Miller eligibility, those scholarships come with you to Wesleyan. The HOPE Scholarship for private college students is a set amount (approximately $2,985 per semester for full-time students at Wesleyan currently). Zell Miller Scholars receive a slightly higher amount (since Zell is awarded to students with a higher GPA/test criteria – essentially it covers full tuition at public institutions, and at private colleges it provides an elevated annual scholarship). You’ll also receive the Georgia Tuition Equalization Grant – a state grant of about $575 per semester for Georgia residents attending a private college. These will all be included in your financial aid package if you qualify. Important: Just be sure you’ve done your FAFSA (or Georgia aid application) so that the state knows you’re attending Wesleyan. We handle the rest by certifying your enrollment. Many of our students combine HOPE/Zell with Wesleyan’s institutional scholarships for an even lower net cost.

A: Great news: the vast majority of Wesleyan’s scholarships for incoming first-year students do not require a separate application. When you apply for admission, you’re automatically considered for all our standard merit scholarships (academic awards based on your high school GPA, test scores, etc.). If you are admitted, we’ll award the appropriate merit scholarship in your acceptance letter. We also have some special scholarship programs (for example, awards for fine arts majors, legacy students, or other specific criteria) – a few of those might involve extra steps like an interview, portfolio, or audition. However, we will invite you to apply or schedule an audition if you meet the qualifications for those programs. You won’t accidentally miss out – our admissions and financial aid teams coordinate to ensure every student gets full consideration for everything they’re eligible for. Just keep an eye on your email and our scholarship website for any such opportunities. But again, your automatic merit scholarship is guaranteed upon admission, with no separate paperwork needed.

A: We begin crafting financial aid offers as early as December for students who are admitted Early Action and have a FAFSA on file. Typically, if you apply in the fall and submit your FAFSA by around January, you can expect to receive an initial financial aid award letter by late winter (Dec–March). For Regular Decision applicants, award letters usually go out soon after admission decisions (which at Wesleyan is rolling). We will send your aid offer via email, and you may also get a paper copy in the mail. The email will have instructions on logging into the Wesleyan portal to view your full award details and accept your aid online. Keep in mind, your package might be updated if new information comes in (for example, if you earn a new scholarship or if there’s a change after verification). If you pay your enrollment deposit, we’ll continue to keep you updated and work with you over the summer on finalizing everything. Bottom line: you won’t be in the dark – our goal is to get you your financial aid information as soon as possible so your family can make an informed college decision. And if you’re ever wondering about the status, just contact us!

A: We understand that the FAFSA may not tell the whole story of your family’s finances. If you have a significant change in circumstance (like a job loss, unusual medical expenses, etc.) or something that isn’t reflected in the tax info on your FAFSA, let us know. Wesleyan has an appeal process where we can review additional documentation and potentially adjust your aid offer to reflect your current need. Also, if a change happens mid-year (after you’ve received aid), don’t hesitate to reach out – we can’t promise an increase in every case, but we’ll do everything we can to find you extra assistance if warranted. Our counselors are compassionate and will guide you through the appeal or special circumstance consideration process. Additionally, we can help with advice on budgeting, finding additional scholarships, or setting up a payment plan to spread payments if needed. The key is: communicate with us. We’re on your side and want to help keep you on track at Wesleyan.

A: No, you are not required to borrow loans if you don’t need or want them. When we create your financial aid package, we include federal student loans as an option because many students choose to use them as a tool to invest in their education. However, it’s entirely up to you and your family to decide. You can accept the amount you’re comfortable with – even $0. Wesleyan’s approach is to maximize scholarships and grants (free money) first, then present loans as a secondary resource to cover any remaining gap. Many students use the federal Direct Subsidized/Unsubsidized Loans because they have low fixed interest rates and flexible repayment, but again, the choice is yours. If you decline a loan or take a smaller amount, just be sure you have another plan (like family contributions or a payment plan) to cover your bill. We’re happy to discuss what loan level, if any, makes sense for you. And remember, loans can be reduced or canceled even after you’ve accepted them, if you change your mind or get additional funds. We’ll work with you to ensure your financing plan is as comfortable as possible.

A: Some families see the word “verification” and worry – but don’t stress. Verification is a routine process where the government randomly selects about 1 in 3 FAFSA applicants to provide backup documents. If you’re selected, it doesn’t mean you did anything wrong or that you won’t get aid; it just means we need to collect a bit of paperwork (like copies of W-2s or a verification worksheet) to confirm the data on your FAFSA. The Financial Aid Office will notify you of exactly what’s needed. Simply send in those documents (we’ll provide instructions – often it can be done electronically). Once everything is verified, we’ll finalize your aid offer. Your grants and loans won’t be held up as long as you complete the process. Don’t panic – we’re here to help you through it and answer any questions. Many families complete verification every year with no issues. Tip: To minimize chances of errors, use the IRS Data Retrieval Tool on the FAFSA if available (it imports tax info directly). But if you get selected anyway, just follow up with us promptly. We’ll make it as smooth as possible.

A: Wesleyan’s Business Office will send you a tuition bill for each semester, typically in July for the fall and December for the spring. The bill will show your charges (tuition, fees, housing, etc.) minus your financial aid (grants, scholarships, loans that are applied). The remaining balance is what you owe out-of-pocket for that semester. Many families choose to set up a monthly payment plan to spread that balance over several months – this can make budgeting easier. For example, instead of one large payment in August, you might pay in 5 smaller installments from August to December. We do offer installment plans; information on how to enroll in one will come with your bill (or you can contact the Business Office to set it up). If your family prefers to pay the semester in full up front, that’s fine too. We just want to be flexible so that payments can fit your budget. Important: your financial aid (scholarships, grants, accepted loans) will be credited to your account at the start of each semester, as long as you’ve completed all requirements. So be sure you’ve signed any loan promissory notes, completed verification, etc., before the semester begins. If you have any concerns about making a payment, talk to us – we can often find a solution or short-term deferment to help.

Regional Admissions Counselor:

Bibb County, Middle Georgia and South Georgia

Email Me: storres@wesleyancollege.edu

Book a Virtual Meeting:

https://calendly.com/storres-

Regional Admissions Counselor:

North Georgia, North Florida and Out of State

Email Me: mwallace@wesleyancollege.edu

Book a Virtual Meeting:

calendly.com/mwallace-wesleyancollege

Paying for college can feel complex, but you are not alone. Our Financial Aid Office staff are real people dedicated to helping you and your family navigate this journey. Please reach out to us anytime – no question is “silly” or too small. We’re happy to explain, clarify, or just offer reassurance.

You can email us at financialaid@wesleyancollege.edu or call (478) 757-5205 to speak with an aid counselor. Prefer a face-to-face meeting? Schedule an appointment and come see us, or set up a video chat – we love getting to know the families we serve. Our mission is to make Wesleyan an affordable reality for you.

We look forward to welcoming you to the Wesleyan family!

Wesleyan College is privileged to steward many arts and cultural events and share them with the community. Most are free and open to the public. Wesleyan art galleries are open M-F 1-5PM and on Wesleyan Market Saturdays from 10AM-2PM.

Event listing

Wesleyan competes in intercollegiate athletics with teams in soccer, softball, basketball, hockey, beach volleyball, indoor volleyball and flag football.

View More

Tour our beautiful 200-acre campus featuring Georgian architecture, lush green spaces, recreational facilities, residence halls, and worship center.

Vist Wesleyan Virtually